Tax Compliance Software Market is Expected to Expand at a CAGR of 12.9%: Demand, Scope, Size, and Growth by 2032

Tax Compliance Software Market Growth

Tax Compliance Software Market Research Report By, Deployment Model, Organization Size, Vertical, Compliance Regulations, Functionality, Regional

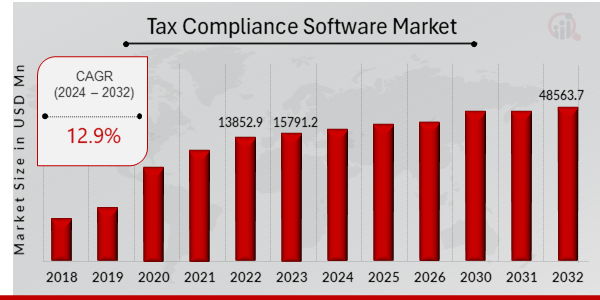

WA, UNITED STATES, January 20, 2025 /EINPresswire.com/ -- The global Tax Compliance Software Market has been experiencing rapid growth and is projected to continue its upward trajectory in the coming years. In 2022, the market size was valued at USD 13,852.9 million and is expected to grow from USD 15,791.2 million in 2023 to USD 48,563.7 million by 2032, exhibiting a compound annual growth rate (CAGR) of 12.9% during the forecast period (2024–2032). This significant growth is driven by the increasing complexity of tax regulations, the rising adoption of automation solutions, and the need for businesses to ensure timely and accurate tax filings.

Key Drivers of Market Growth -

➤ Increasing Complexity of Tax Regulations As tax laws and regulations become more complex and dynamic across various regions and industries, businesses are increasingly relying on tax compliance software to manage their tax obligations efficiently. The software helps organizations stay up-to-date with the latest tax laws, ensuring accurate calculations and filings.

➤ Rising Demand for Automation in Tax Processes The demand for automation in financial and accounting processes is growing, as companies seek to streamline operations and reduce human error. Tax compliance software automates the tax calculation, filing, and reporting processes, which enhances accuracy, reduces administrative burden, and saves time.

➤ Growing Adoption of Cloud-Based Tax Solutions Cloud-based tax compliance software is gaining traction due to its scalability, flexibility, and cost-efficiency. With cloud solutions, businesses can access real-time data, collaborate seamlessly across departments, and ensure secure storage of sensitive financial information, driving the adoption of cloud-based tax solutions.

➤ Need for Data Security and Accuracy in Tax Filing The rising number of tax-related fraud cases and stringent data security regulations have pushed businesses to adopt more secure and accurate solutions for tax filing. Tax compliance software offers built-in security features, minimizing the risks associated with manual errors or fraudulent activities, thereby fostering the market's growth.

Download Sample Pages - https://www.marketresearchfuture.com/sample_request/23062

Key Companies in the Tax Compliance Software Market Include

• CCH Tagetik

• Avalara

• Intuit

• PwC

• Thomson Reuters

• EY

• Sovos

• Vertex

• Taxware International

• Wolters Kluwer

• TaxJar

• KPMG

• Deloitte

• Thomson Reuters (formerly Checkpoint)

• Anadea

• SAP

Browse In-Depth Market Research Report: https://www.marketresearchfuture.com/reports/tax-compliance-software-market-23062

Market Segmentation

By Product Type

• On-Premise Tax Compliance Software: Software installed and run on the user's own servers and infrastructure, offering greater control over data security and customization.

• Cloud-Based Tax Compliance Software: Cloud-based solutions that offer scalability, real-time data access, and reduced maintenance costs.

• Hybrid Tax Compliance Software: A combination of on-premise and cloud-based solutions that provide flexibility and integration with existing systems.

By Application

• Small and Medium Enterprises (SMEs): A growing number of SMEs are adopting tax compliance software to manage their tax filings, particularly in emerging markets where tax regulations are evolving.

• Large Enterprises: Larger companies often require more sophisticated tax compliance software to manage complex tax structures, international filings, and integration with other enterprise systems.

• Tax Advisors and Accountants: Tax professionals use these software solutions to provide tax-related services to clients, offering automation, accuracy, and efficiency in their work.

By Distribution Channel

• Direct Sales: Sales made directly to businesses through sales teams or consultants.

• Retail & E-commerce: Growing distribution through online platforms, making it easy for businesses to purchase and implement tax compliance software.

• Partner Channels: Third-party vendors and consultants who help businesses implement tax compliance solutions.

By Region

• North America: Leading the market due to the presence of major tax software companies and stringent tax regulations in the U.S. and Canada.

• Europe: Significant growth driven by the increasing adoption of tax compliance solutions across various industries and countries, such as the U.K., Germany, and France.

• Asia-Pacific: The fastest-growing region, fueled by rapid digitalization, increasing tax regulations, and the growing need for businesses in countries like China and India to streamline their tax processes.

• Rest of the World (RoW): Steady growth expected in Latin America, the Middle East, and Africa as businesses look to enhance compliance with tax laws and regulations.

Procure Complete Research Report Now - https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=23062

The Tax Compliance Software Market is set to experience robust growth, driven by the increasing complexity of tax regulations, the need for automation, and the growing demand for cloud-based solutions. As businesses face challenges in maintaining compliance, tax compliance software is becoming an essential tool for ensuring accurate, efficient, and secure tax filings. With continuous innovation and the rising adoption of digital solutions, the market is expected to play a key role in shaping the future of tax management worldwide.

Related Report –

Led Stadium Screens Market

https://www.marketresearchfuture.com/reports/led-stadium-screens-market-23849

Led Tube Market

https://www.marketresearchfuture.com/reports/led-tube-market-23928

Machine Vision Lighting Market

https://www.marketresearchfuture.com/reports/machine-vision-lighting-market-23931

Mobile And Portable Spectrometers Market

https://www.marketresearchfuture.com/reports/mobile-portable-spectrometers-market-24062

Mobile Broadband Modem Market

https://www.marketresearchfuture.com/reports/mobile-broadband-modem-market-24073

About Market Research Future (MRFR)

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release