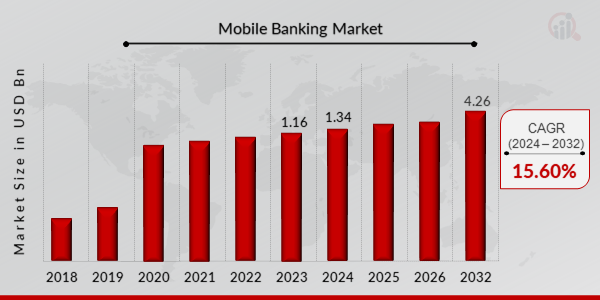

Mobile banking Market CAGR to be at 15.60% from 2024 to 2032 | 4.26 Billion Industry Revenue by 2032

Mobile banking Market Growth

Mobile Banking Market Research Report Information By, Type, Platform, Deployment, End User, and Region

CO, UNITED STATES, January 14, 2025 /EINPresswire.com/ -- The global mobile banking market has experienced rapid growth, driven by increasing smartphone penetration, advancements in digital technology, and growing demand for convenient and secure financial services. In 2023, the market size was valued at USD 1.16 billion and is projected to grow from USD 1.34 billion in 2024 to an impressive USD 4.26 billion by 2032, reflecting a compound annual growth rate (CAGR) of 15.60% during the forecast period (2024–2032). Mobile banking systems empower users to perform financial and banking activities through telecommunication devices, ranging from basic SMS services to sophisticated financial management and investment solutions.

𝐊𝐞𝐲 𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐌𝐨𝐛𝐢𝐥𝐞 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐌𝐚𝐫𝐤𝐞𝐭

• Bank of America Corporation

• BNP Paribas S.A.

• Citigroup Inc.

• Infosys Limited

• JPMorgan Chase & Co.

• HSBC Holdings PLC

• American Express Company

• Temenos Group AG

• CréditAgricole Group

• Wells Fargo & Company

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐚𝐠𝐞𝐬 https://www.marketresearchfuture.com/sample_request/2906

𝐊𝐞𝐲 𝐃𝐫𝐢𝐯𝐞𝐫𝐬 𝐨𝐟 𝐌𝐚𝐫𝐤𝐞𝐭 𝐆𝐫𝐨𝐰𝐭𝐡

➤ Smartphone Penetration and Internet Connectivity

The global increase in smartphone users and access to high-speed internet has significantly fueled the adoption of mobile banking. Enhanced connectivity enables users to access financial services anytime, anywhere, boosting convenience and user satisfaction.

➤ Shift to Digital-First Financial Services

With digital transformation becoming a priority for financial institutions, mobile banking is at the forefront of their strategies. This shift includes offering seamless digital experiences, personalized services, and secure platforms to attract and retain customers.

➤ Rising Demand for Convenience and Security

Customers are increasingly seeking quick and secure access to their financial accounts. Mobile banking provides a range of services, from checking account balances to transferring funds, paying bills, and managing investments, all through user-friendly and secure applications.

➤ Technological Advancements in Mobile Banking Apps

Integration of advanced technologies like artificial intelligence (AI), machine learning (ML), biometric authentication, and blockchain has enhanced the functionality, security, and efficiency of mobile banking applications. AI-driven chatbots, personalized financial recommendations, and fraud detection systems are examples of how technology is shaping the market.

➤ Government Initiatives and Financial Inclusion

Governments worldwide are promoting financial inclusion by encouraging the adoption of digital financial services, including mobile banking. In emerging economies, mobile banking plays a vital role in providing banking access to unbanked and underbanked populations.

𝐁𝐫𝐨𝐰𝐬𝐞 𝐈𝐧-𝐝𝐞𝐩𝐭𝐡 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.marketresearchfuture.com/reports/mobile-banking-market-2906

𝐌𝐚𝐫𝐤𝐞𝐭 𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧

The mobile banking market is segmented based on service type, deployment model, application, and region to provide an in-depth analysis.

1. By Service Type

Transactional Services: Fund transfers, bill payments, and mobile recharges.

Non-Transactional Services: Account balance inquiries, mini statements, and loan-related queries.

Investment Services: Access to mutual funds, stocks, and other financial instruments.

Other Services: Customer support and financial advice.

2. By Deployment Model

On-Premise: Banks managing mobile banking services through in-house infrastructure.

Cloud-Based: Growing preference for cloud-based solutions due to scalability, cost efficiency, and ease of maintenance.

3. By Application

Personal Banking: Individuals using mobile banking for day-to-day financial activities.

Business Banking: Small, medium, and large enterprises adopting mobile banking for payroll, tax payments, and transaction monitoring.

4. By Region

North America: The largest market, driven by high smartphone penetration, advanced banking infrastructure, and early adoption of technology.

Europe: Growth fueled by increasing investments in digital banking and the presence of major financial institutions.

Asia-Pacific: Fastest-growing region, supported by a growing middle-class population, increasing internet penetration, and government initiatives for financial inclusion.

Rest of the World (RoW): Steady growth expected in Latin America, the Middle East, and Africa, with mobile banking addressing the needs of unbanked populations.

𝐏𝐫𝐨𝐜𝐮𝐫𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐍𝐨𝐰: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=2906

The mobile banking market is poised for significant growth as financial institutions continue to enhance their digital offerings and adopt innovative technologies. With rising consumer demand for secure, convenient, and accessible financial services, mobile banking is set to play a pivotal role in the global financial ecosystem, bridging gaps in financial inclusion and driving digital transformation.

Related Report –

Locker Market -

https://www.marketresearchfuture.com/reports/locker-market-22884

Impact Investing Market -

https://www.marketresearchfuture.com/reports/impact-investing-market-22940

High Yield Bonds Market -

https://www.marketresearchfuture.com/reports/high-yield-bonds-market-22949

High Net Worth Offshore Investment Market -

https://www.marketresearchfuture.com/reports/high-net-worth-offshore-investment-market-22960

Nano Robots Market -

https://www.marketresearchfuture.com/reports/nano-robots-market-22497

𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐅𝐮𝐭𝐮𝐫𝐞 At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release