At a Glance

- Corn prices find a 2% boost, with soybeans jumping nearly 3% higher

- Wheat prices grab moderate gains following new Russian attacks

- Plus: Don’t forget to check out Feedback From The Field!

Grain prices vaulted into the green on Thursday following a series of bullish factors that included flooding in Brazil and new Russian attacks against Ukrainian port infrastructures. Soybeans found the strongest gains, pushing almost 3% higher. Corn prices were up around 2%. Wheat captured variable gains that mostly ranged between 0.5% and 2%.

Ample rains will hit the Corn Belt between Friday and Monday, with many areas set to gather another 1” to 2” total accumulation, per the latest 72-hour cumulative precipitation map from NOAA. Later on, NOAA’s new 8-to-14-day outlook predicts more seasonally wet weather for the central U.S. between May 9 and May 15, with colder-than-normal conditions building back into the Plains.

On Wall St., the Dow climbed another 283 points higher to 38,187 as investors await an incoming round of corporate earnings reports and a fresh set of jobs data later this week. Energy futures were mixed but mostly lower. Crude oil eased 0.25% lower, staying just below $79 per barrel. Diesel faded 0.4% lower, while gasoline firmed more than 0.5%. The U.S. Dollar softened moderately.

On Wednesday, commodity funds were net buyers of corn (+3,000), soybeans (+3,000) and soyoil (+1,000) contracts but were net sellers of soymeal (-1,500) and CBOT wheat (-2,000).

Corn

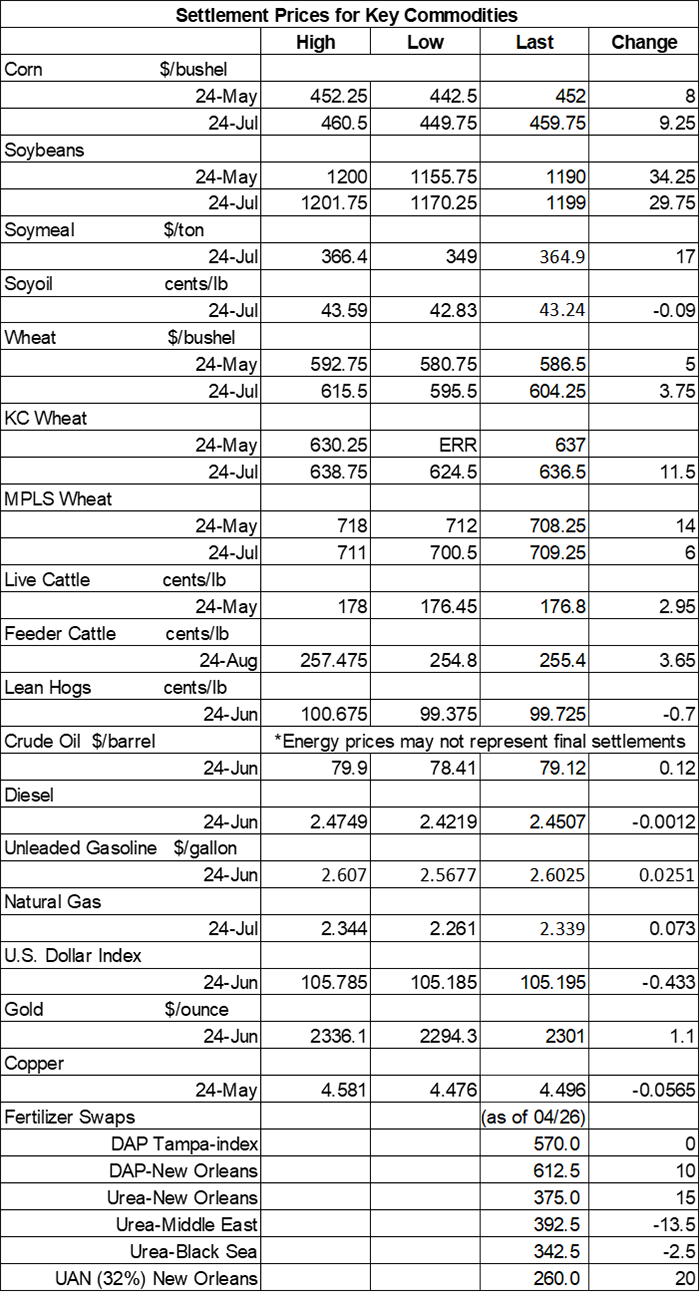

Corn prices tracked around 2% higher on a round of technical buying as traders remained watchful for potential planting delays in the U.S. and another lower production estimate coming out of Argentina. May futures rose 8 cents to $4.5125, with July futures up 9.25 cents to $4.60.

Corn basis bids held steady across the central U.S. on Thursday.

Corn exports saw combined old and new crop sales reach 31.2 million bushels last week. Old crop sales faded 42% lower week-over-week, and total sales were toward the lower end of analyst estimates, which ranged between 25.6 million and 63.0 million bushels. Cumulative sales for the 2023/24 marketing year are more than 300 million bushels ahead of last year’s pace so far, with 1.308 billion bushels.

Corn export shipments eased 14% below the prior four-week average, with 54.4 million bushels. Mexico, Japan, South Korea, Colombia and Honduras were the top five destinations.

Various fundamental aspects are lining up to potentially suggest the low price for 2024 corn may be in place, according to Naomi Blohm, senior market adviser with Stewart Peterson. Is a rally now looming? Blohm addresses that question and looks at some various factors that could call in the bulls in today’s Ag Marketing IQ blog – click here to learn more.

Argentina’s Buenos Aires grains exchange made another sharp cut in its latest forecast for the country’s 1.831 billion bushels. The group cited poor weather and damage from a severe leafhopper infestation as the primary causes.

Corn settlements on Wednesday were for 255,425 contracts.

Soybeans

Soybean prices grabbed sizable gains on a round of technical buying that was largely spurred by flooding in Brazil and possible planting delays in the U.S. May futures climbed 34.25 cents to $11.90, with July futures up 29.75 cents to $12.00.

The rest of the soy complex was mixed. July soymeal futures leaped more than 4.75% higher, while July soyoil futures slid 0.25% lower.

Soybean basis bids were steady to firm after trending 5 to 10 cents higher at three Midwestern processors on Thursday.

Soybean exports found a combined 15.5 million bushels in old and new crop sales last week. Old crop sales improved 45% above the prior four-week average. Total sales were near the middle of analyst estimates, which ranged between 3.7 million and 33.1 million bushels. Cumulative sales for the 2023/24 marketing year are still tracking moderately below last year’s pace after reaching 1.410 billion bushels.

Soybean export shipments fell to a marketing-year low of 9.9 million bushels. Japan, Indonesia, Mexico, Colombia and Vietnam were the top five destinations.

As another crop season kicks off, Farm Futures grain market analyst Jacqueline Holland is assembling a new batch of Feedback from the Field updates, which is populated with farmer comments from around the Heartland. Click this link to take the survey and share updates about your farm’s spring progress. Holland reviews and uploads results daily to the FFTF Google MyMap, so farmers can see others’ responses from across the country.

Brazil’s No. 2 soybean production state, Rio Grande do Sul, is experiencing heavy rains that are disrupting its soybean harvest, which reached 66% completion through April 25. “Torrential rains in Rio Grande do Sul have already caused numerous disruptions and losses,” according to meteorologist Marco dos Santos. Heavy rains are expected to continue through this weekend.

Soybean settlements on Wednesday were for 139,791 contracts.

Wheat

Wheat prices found variable gains on a round of technical buying partly spurred by ongoing geopolitical tensions in the Black Sea region. Spillover strength from corn and soybeans lent additional support. July Chicago SRW futures added 3.75 cents to $6.03, July Kansas City HRW futures rose 11.5 cents to $6.3650, and July MGEX spring wheat futures gained 6 cents to $7.0825.

Wheat exports only reached 14.2 million bushels in combined old and new crop sales last week. That was near the middle of analyst estimates, which ranged between 3.7 million and 25.7 million bushels. Cumulative sales for the 2023/24 marketing year are still slightly ahead of last year’s pace, meantime, with 614.9 million bushels.

Wheat export shipments slid 8% below the prior four-week average to 18.7 million bushels. China, Vietnam, Mexico, Japan and Italy were the top five destinations.

For the third consecutive day, Russian missiles struck targets in the Ukrainian port city of Odesa. The latest attack started a large fire and injured 14 people. Eight people were killed in attacks earlier this week. Port infrastructure in Odesa has been a frequent target of Russian strikes.

Jordan issued a new international tender to purchase 4.4 million bushels of milling wheat from optional origins that closes on May 7. Jordan made no purchases in its prior tender that closed on Tuesday. If any grain is purchased in the new tender, it will be for shipment in June and July.

CBOT wheat settlements on Wednesday were for 102,089 contracts.

About the Author(s)

You May Also Like